Akropolis is a blockchain-based platform uniting pension fund managers, app developers, and institutional and individual users in one ecosystem.

Akropolis is a technology company building a decentralized platform to alleviate some of the inefficiencies in today’s pension system.

Former Legman Brothers investor Anastasia Andrianova founded Akropolis in 2018, with Andrianova currently serving as the platform’s CEO

The project has raised around 22,000 worth of Ether (ETH) during two rounds of the Akropolis pre-sale held earlier this year. Meanwhile, the company has scheduled its initial coin offering (ICO) in September 2018.

Akropolis will put a maximum of 360,000 Akropolis external tokens (AKTs)—or 40 percent of the total token supply—up for sale. Moreover, the company has set a hard cap of US$25 million for the token sale.

Flawed Pension Systems

Akropolis believed that most pension systems currently in effect are unfit to fulfill the needs of the modern world.

Multiple reports suggest that the retirement savings gap keeps on growing. According to Akropolis, the continued widening of the pensions gap could spark a global financial crisis.

The system has failed to keep up with the current situation. As life expectancy rises, retirement life becomes longer and, in effect, more expensive. Compounded to that problem was the fact that the price of necessities all around the world keeps on increasing, which leaves young professionals no choice but to allocate less for their retirement funds.

The lack of transparency has also hurt the pension system. A complicated payment structure not only confused clients but also managed to siphon off a part of their funds away.

Akropolis hopes to solve most of the problems plaguing the pension systems by creating a transparent and efficient platform using blockchain technology.

Decentralized Pension Protocol

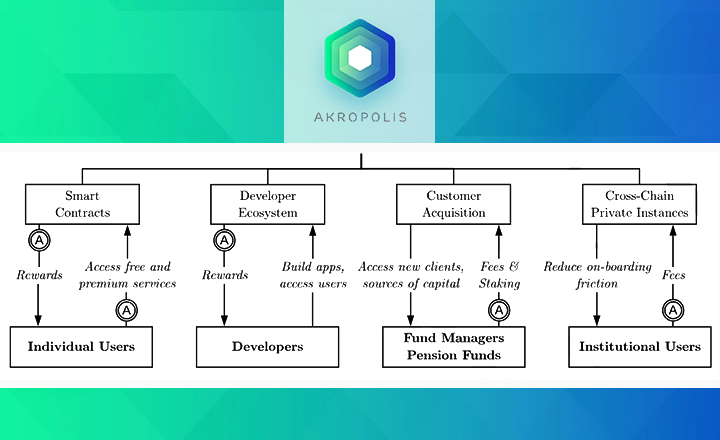

The Akrapolis platform is a multi-chain network that will serve as the bridge linking users and pension fund managers together.

The Akrapolis platform is a multi-chain network that will serve as the bridge linking users and pension fund managers together.

Fund managers and pension funds can attract a number of potential customers inside the Akropolis network. These managers have to pay in AKT in exchange for access and permission to offer their services to multiple pension funds and both institutional and individual users inside the network.

Meanwhile, these individual users can use these services in exchange for the corresponding amount in AKTs. Users can choose between free and premium services provided on the network. Since the blockchain keeps personal information private, users can opt to sell their data in exchange for tokens.

Institutional users can then choose to buy the data using AKT. Similarly, this kind of users can also gain access to the services offered on the network.

Application developers can also pay using AKT for the right to access the market inside the network. They can use some of the tools provided to create apps, which they can sell to users on the platform. Developers can receive rewards in tokens as payment for their services.

Best Shot at Resolving Problems?

The imminent pension crisis could not be avoided. Akropolis admitted that blockchain technology alone is not the solution to the problems affecting pension systems.

However, the blockchain-based Akropolis platform hopes to address some of the difficulties facing the industry today. Furthermore, the company is confident that uniting the community using decentralized technology is the best bet at correcting the imperfections of the system, as well as replacing the current structure with a more modern and more beneficial one.