Bitcoin (BTC) manages to gain momentum and will likely trade above $8,300 in the next sessions, but altcoins like ETH and XRP are in the red.

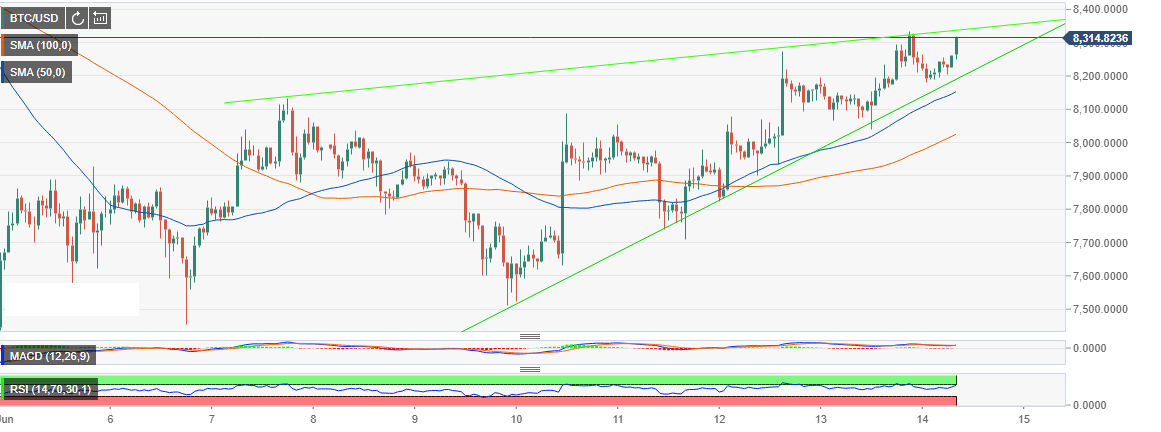

BTC/USD

Bitcoin (BTC) on Thursday started gaining enough momentum to push its price above the $8,300 level today. The BTC/USD pair, however, failed to hang on as it dropped a few marks, reaching below $8,200. At the time of writing, BTC/USD finds its way back up as it trades at $8,293.67, with a 1.63-percent change in the last 24 hours.

With such bullish momentum, BTC/USD may continue trading above $8,300 in the coming sessions, with FX Street pointing out:

“…the rising wedge pattern is also approaching a breakout that is likely to place Bitcoin in a fresh path towards the next resistance at $8,400. Looking at the chart, Bitcoin has tremendous support starting with $8,200, $8,100, $8,000 and $7,700. The 50 SMA and the 100 SMA currently playing catchup suggest further correction north.”

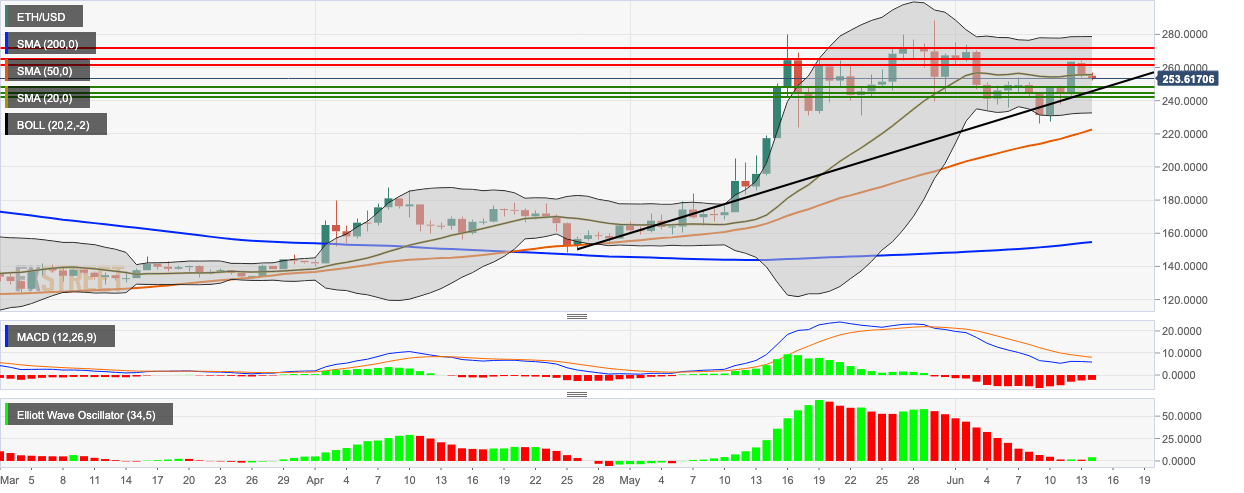

ETH/USD

Ethereum (ETH) failed to sustain its upward movement Thursday as it dropped from above $260 down to the $255 level. The ETH/USD trades $256.18 by press time, registering a 1.08-percent difference from the same time yesterday.

According to a report by FX Street:

“The 20-day Bollinger band has narrowed, indicating lower market volatility. and the latest price session in the daily chart has gone below the 20-day simple moving average (SMA 20) curve. The price is still trending above the SMA 200 and SMA 50 curves and has found support on the upward trending line. The nearest support level lies at $249 and the closest resistance level is at $261.25.”

| RELATED: Key Adoption Pushes Ethereum (ETH) Price to Rise

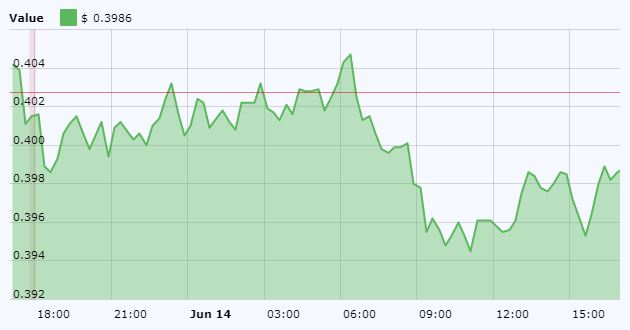

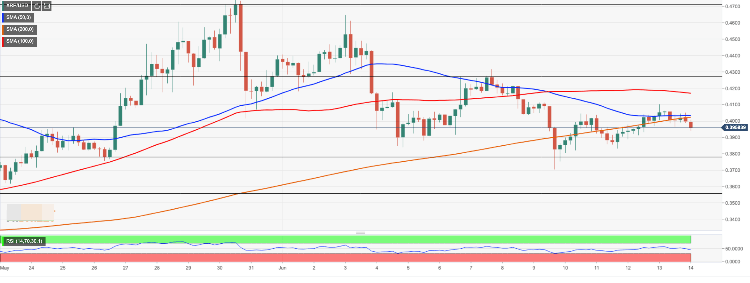

XRP/USD

Ripple (XRP) took a hit early Friday as it ran out of fuel after breaking above $0.404. The XRP/USD pair continued south until reaching $0.3945. The pair has slightly recovered, but is still halfway through its peak today. At the time of writing, XRP/USD trades at $0.3986, with a 1.59-percent 24-hour change.

FX Street reported:

“The initial support comes at $0.3900, followed by Jun 12 low at $0.3889. However, the most important support lies at $0.3700. This support area is created by a confluence of strong technical indicators, including SMA50 (Simple Moving Average) on a weekly chart, SMA50 on a daily chart and the weekly low. Once it is cleared, the downside is likely to gain traction with the next focus on $0.3550 (61.8% Fibo retracement).”

| RELATED: Bitcoin, Ethereum Need More Push for Big Comeback

Source: FX Street