The bulls need to push the BTC/USD pair to clear the $11,450 level if they wish the Satoshi Nakamoto coin to go on an upward movement to close the week.

BTC/USD

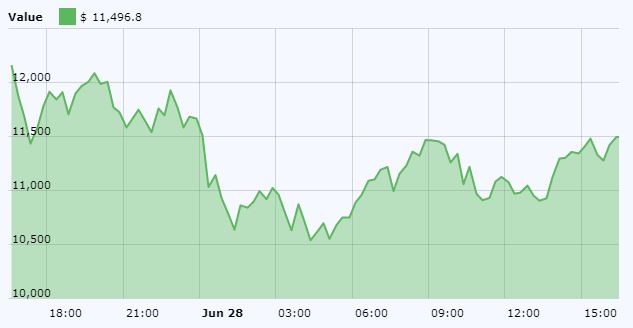

Bitcoin (BTC) ran out of steam Thursday when it failed to keep its price above the $13,000 level. Within 24 hours, the BTC/USD pair dropped by as much as $3,000.

The good news, though, is that BTC is poised to continue trading above $11,000. The pair currently trades at $11,496.80, with a seven-percent change in the past 24 hours.

FX Street reported that the next critical resistance is at $11,450, noting the following resistance and support levels:

Resistance Levels

- $11,450 – 38.2% Fibo retracement daily, Pivot Point 1-month Resistance 2

- $11,700 – SMA100 1-hour

- $12,150 – SMA10, 4-hour, Pivot Point 1-week Resistance 3

Support Levels

- $11,000 – SMA10 (Simple Moving Average) 1-hour, 23.6% Fibo retracement daily.

- $11,200 Pivot Point 1-week Resistance 2, the highest level of the previous week$10,700 – Pivot Point 1-week Resistance 1.

- $10,350 – the lower line of 4-hour Bollinger Band.

Meanwhile, altcons like Ripple (XRP) and Ethereum (ETH) slowly recover. The XRP/USD pair trades at $0.4114, while the ETH/USD pair at $301.19, at press time.