Cryptocurrencies posted an upward trend during the fifth week of May after the ongoing Italian crisis caused a drop on the Italian and European markets.

The bulls have the last say this week, as cryptocurrency prices ended on the green. After following a downward trend for more than three weeks, cryptos seemed to have recovered from May 28 to June 1. Crypto holders can thank the troubled Italians for that. Meanwhile, important launches for some altcoins made their price move in a slightly different direction compared to the general trend. Find out more about the contributing factors in this Crypto Exchange WK5 2018 roundup.

The bulls have the last say this week, as cryptocurrency prices ended on the green. After following a downward trend for more than three weeks, cryptos seemed to have recovered from May 28 to June 1. Crypto holders can thank the troubled Italians for that. Meanwhile, important launches for some altcoins made their price move in a slightly different direction compared to the general trend. Find out more about the contributing factors in this Crypto Exchange WK5 2018 roundup.

The Eurozone in Danger, Again

The biggest factor of this week’s gains comes from the shaky European Union (EU). Euro—the fiat currency of 19 EU member states—is once again on the verge of collapsing as a political crisis looms over Italy, the eurozone’s third-largest economy.

The country’s political trouble stems from Paolo Savona, candidate to become Italy’s finance minister. Savona, nominated by leftist parties Movimento 5 Stelle (Five Star Movement) and Lega Nord (Northern League), is a notorious Eurosceptic who once suggested Italy leaving the EU.

Italian President Sergio Mattarella, responsible for approval of any ministerial nomination, rejected Savona. According to Mattarela, appointing a staunch Eurosceptic would send the message that the Italians are ready to leave the eurozone and even EU.

After the president rejected Savona’s nomination, prime minister-in-waiting Giuseppe Conte—also a choice of the two parties—resigned from his post. The Italians now remain without a formal government three months after their elections and are on course to holding another snap election.

The possibility of a more populist and anti-euro government being installed scared investors, causing the Italian market to drop and creating shockwaves all across EU markets.

Yanis Varoufakis, former Greek finance minister, wrote in an editorial:

“I have it on good authority that the German finance ministry, the European Central Bank and every major bank and corporation have plans in place for the possible exit from the eurozone of Italy.”

With the uncertainty over euro’s future, market participants have shifted to less risky assets. Among those, the most notable are cryptocurrencies.

John Spallanzani, portfolio manager at Miller Value Parters, said:

“Bitcoin finally catches a bid after Italian 2-year yield spikes 155bps – Italy’s new 5 Star party threatens exit from Eurozone which has once again put the Idea of a Euro breakup in the forefront of investors’ minds.”

Most—if not all—cryptocurrency prices then posted an upward trend, which signals the start of regaining the losses after cryptos’ poor performance during the first four weeks of May.

| Related: Crypto Exchange May WK4 2018

Italians Revive Bitcoin Cash, Other Cryptos

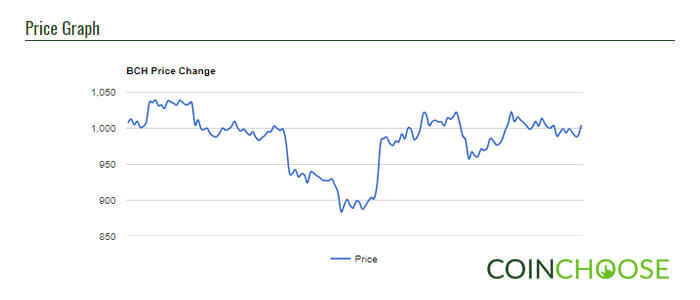

Bitcoin Cash’s (BCH) price increased its value by 12.16 percent during the week of May 28 to June 1. While analysts figured that this increase is mainly due to the Italian crisis, they are thankful that the altcoin managed to survive its own problem.

Bitcoin Cash’s (BCH) price increased its value by 12.16 percent during the week of May 28 to June 1. While analysts figured that this increase is mainly due to the Italian crisis, they are thankful that the altcoin managed to survive its own problem.

Observers accused Bitcoin Cash and CNBC’s Fast Money of cooperating with each other after the latter’s bullish stance regarding the former. Analysts believe that this made a negative impact toward the coin’s prices and it showed last weekend, May 26 to 27, when Bitcoin Cash’s value dropped by more than 17 percent. However, like every other cryptocurrencies, Bitcoin Cash’s price was saved by the Italian crisis. Bitcoin Cash is now trading at US$999.554.

TRON (TRX) continues to disappoint as the 10th largest digital coin performed the worst this week, with only 1.27 percent price increase. The altcoin’s price lost almost 1.57 percent of its value after the TRON MainNet launch last May 31. Some have already expected this drop, since a price decrease also happened in TRON’s TestNet launch last March. However, analysts expect TRON to experience a price boom after all TRX tokens complete their migration to the MainNet this June 22. TRON is currently valued at US$0.061423.

IOTA (MIOTA) is this week’s best performing coin among the top 10. The ninth largest digital coin increased by 30.37 percent in value during the course of the week. The biggest factor for IOTA’s good performance is the Trinity Mobile wallet beta release. Trinity, a community project adopted by the IOTA foundation, is a simple crypto wallet marketed toward not so tech-savvy investors. As the overall market goes up, holders can hope that the IOTA price continues to follow this rising trend. MIOTA is currently priced at US$1.76.

Meanwhile, Bitcoin’s value increased by only 5.41 percent this week, as it continues to bounce off the resistant level of US$7,600. Technical analysts suggest that the coin’s poor showing copies the pattern it took after the collapse of crypto exchange Mt.Gox four years ago.

Paul Day, technical analyst at Market Securities Dubai Ltd., said:

“The emotions are no different from the last time this happened, it’s just a different set of people going through it.”

If the biggest cryptocurrency fails to break its resistance level in the following days, Bitcoin’sprice could see a more bearish pattern in the future. Bitcoin currently trades at US$7522.03.

In general, analysts suggest crypto holders to be patient once more, as they foresee an increase in demand for virtual currencies this coming FIFA World Cup in Russia. Since the host nation suffers from multiple US financial sanctions, visitors and businesses look for ways to circumvent these sanctions. Analysts see the decentralized cryptocurrencies as the leading option in bypassing US sanctions.

| Related: Bitcoin Cash: Peer-to-Peer Electronic Cash for All