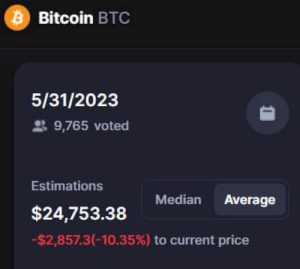

The community price estimate is based on the user votes. The estimates do not guarantee end-of-month prices, it is interesting to see how the tide shifts.

Bitcoin’s current price struggle has caught the attention of investors eager to know where it’s heading by the end of May. The cryptocurrency community over at CoinMarketCap has shared their thoughts on where the price might be headed based on the collective opinions of 9,765 members. According to their estimates, Bitcoin’s price may experience a significant decline by the end of May.

However, it’s important to note that these predictions are based only on the votes of its users and do not necessarily guarantee end-of-month prices.

At the time of publication, if the community’s predictions prove correct, Bitcoin’s price will trade at an average price of $24,753 on May 31 – a decline of -10.35% or -$2,857. Bitcoin’s price is currently trading at $27,586, a decrease of 0.22% in the last 24 hours. The cryptocurrency has also experienced a decline of 3.75% over the previous week, leaving investors uncertain about its future prospects.

Source: CoinMarketCap

Current Bitcoin Price Analysis

Despite this, Bitcoin’s market capitalization stands at $534 billion, underlining its influence and importance in the cryptocurrency market. Examining the distribution of purchases made at specific price levels in the Bitcoin market reveals that more BTC was purchased at certain points. However, this observation could indicate a lack of robust buying support in the event of a further bearish movement.

It’s also worth noting that the percentage of Bitcoin holders in profit has decreased to 64.98%, the lowest point since March. However, similar drops in the rate of holders in profit occurred earlier this year and have proven to be relatively short-lived, thanks to increased buying pressure. As always, investing in Bitcoin is speculative, so keep your wits about you.

Distribution of BTC buying levels

The Bitcoin market’s purchase behavior at specific price levels has been a topic of interest lately. IntoTheBlock’s visualization of the data on May 10 shows a big bubble, indicating that more BTC was bought at a certain point.

It’s worth noting that the historical demand has been low below the current price level, only starting to pick up around $24,000. This could mean that the market lacks strong buying support if the price continues to decrease.

Interestingly, there is more buying activity as the price approaches $30,000. This is consistent with other on-chain indicators that suggest long-term holders are not selling at these levels. Instead of creating resistance in an upward movement, these levels could indicate more buying pressure if the price recovers in the future.

Source: IntoTheBlock

It is also essential to take note of the decreasing percentage of Bitcoin holders currently in profit, which presently stands at 64.98% – the lowest point since March. However, similar drops in the rate of holders in profit occurred earlier this year and have proven to be relatively short-lived, thanks to increased buying pressure.