Cryptocurrency traders felt relieved as prices experienced a slight recovery following a bearish June. Know more in this Crypto Exchange July WK1 Roundup.

News around the world suggests that some countries are showing their warmer side to cryptocurrencies. According to reports, at least two governments are pointing toward legislating regulations favoring crypto and blockchain companies. These reports strengthened further the slight recovery of crypto prices after a bearish June market. Know these and more in this week’s Crypto Exchange July WK1 2018 Roundup.

News around the world suggests that some countries are showing their warmer side to cryptocurrencies. According to reports, at least two governments are pointing toward legislating regulations favoring crypto and blockchain companies. These reports strengthened further the slight recovery of crypto prices after a bearish June market. Know these and more in this week’s Crypto Exchange July WK1 2018 Roundup.

Positive Regulation Around the World

The cryptocurrency industry could have access to banking services in Switzerland before the end of the year, according to a Swiss policymaker. The Alpine country serves as the residence of Crypto Valley, a hub of crypto and blockchain-related companies located in the Swiss city of Zug.

According to a report by the Financial Times, the canton of Zug and the Swiss financial authorities are willing to discuss removing regulatory obstacles keeping crypto companies in Crypto Valley from operating with banks. Heinz Tannler, finance director of Zug canton, argued that regulations should be relaxed—but still within the anti-criminal safeguards—in order to avoid losing these companies to other countries.

Tannler said:

“We hope to clarify relationships by the end of the last year at the latest. Time is pressing—other jurisdictions such as Malta and Singapore are very active and making a lot of effort to attract these companies. The lack of access to bank services is a significant competitive disadvantage. We have to push certain national institutions to resolve this problem quickly and effectively, but that now seems to be going well.”

Crypto traders in the Korean peninsula are also in for some good news. South Korean news publication The-BChain reported that the government would release an industry classification system that recognizes crypto exchange platforms. The report added that these exchanges would be placed under the “encrypted asset sales and brokerage” classification. The system, however, is not yet final, and the government is expected to publicly release it at the end of July.

Joseph Young, crypto analyst, said:

“For the First time, the gov’t of South Korea will recognize crypto exchanges as regulated financial institutions. Previously, crypto exchanges were considered as “communication vendors.” Now, they are categorized as crypto asset exchange.”

These favorable regulatory moves have pushed cryptocurrency prices upward. In addition, analysts have described the increase as a slight recovery after most cryptos lost a huge percentage of their values in the month of June. All of the top 10 cryptocurrencies according to market capitalization have posted increases in the duration of this week, July 2 to 6.

Bitcoin Cash, Cryptos in the Green

The reliability of the Bitcoin Cash (BCH) is under question once more after another group scheduled a stress test on the altcoin’s network. Bitcoin Cash supporter Bitcoin.com has reported earlier this week that engineers and the community will flood the coin’s blockchain on September 1. The test’s purpose is to measure how the Bitcoin Cash network can handle heavy load and traffic. Observers noted the timely schedule of the test that is 10 weeks before Bitcoin Cash’s biannual upgrade scheduled in November.

The reliability of the Bitcoin Cash (BCH) is under question once more after another group scheduled a stress test on the altcoin’s network. Bitcoin Cash supporter Bitcoin.com has reported earlier this week that engineers and the community will flood the coin’s blockchain on September 1. The test’s purpose is to measure how the Bitcoin Cash network can handle heavy load and traffic. Observers noted the timely schedule of the test that is 10 weeks before Bitcoin Cash’s biannual upgrade scheduled in November.

The BCH Stress Test site wrote:

“We are aiming to process over 5 million minimum fee transactions within a 24 hour period on the main BCH chain. Processing over 5 million transactions will showcase the Bitcoin BCH network capacity today, and will be a positive signal for merchants, businesses and investors, giving them confidence in the Bitcoin BCH network and its ability to scale on-chain.”

This report caused uneasiness on the market, as suggested by the Bitcoin Cash price graph. While it recorded some growth during the week, the altcoin’s 0.9 percent increase is the lowest among the top 10. Bitcoin Cash—the fourth largest virtual coin based on market cap—started at US$739.25 on July 2 and ended the week at US$745.83 on July 6.

Crypto exchange platform Binance announced on July 3 that it reopened deposits and withdrawals of EOS (EOS). This is after the exchange suspended transactions involving EOS tokens last May because of a delay in EOS’ Mainnet launch. Following the launch and validation of the EOS Mainnet in June, Binance has deemed it safe to allow EOS transactions back to the platform.

Crypto exchange platform Binance announced on July 3 that it reopened deposits and withdrawals of EOS (EOS). This is after the exchange suspended transactions involving EOS tokens last May because of a delay in EOS’ Mainnet launch. Following the launch and validation of the EOS Mainnet in June, Binance has deemed it safe to allow EOS transactions back to the platform.

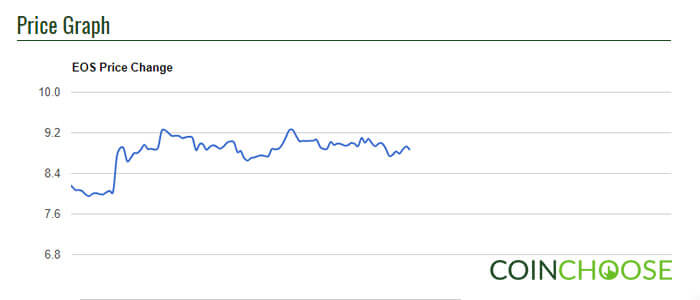

EOS this week recorded the largest percentage increase among the top 10 digital coins. The value of the fifth largest crypto coin—with a market cap of US$7.89 billion—has increased by an impressive 9.1 percent. EOS’ price was at US$8.14 on June 2, before it rose to US$8.88 four days later.

News spread this week that Bitcoin’s founder, Satoshi Nakamoto, is going to publish a new book. According to a website bearing Nakamoto’s name, he will release a book detailing the history of the Bitcoin idea and of Nakamoto himself.

News spread this week that Bitcoin’s founder, Satoshi Nakamoto, is going to publish a new book. According to a website bearing Nakamoto’s name, he will release a book detailing the history of the Bitcoin idea and of Nakamoto himself.

The author claiming to be Satoshi wrote:

“The principles for bitcoin originated from the cyberpunks, a community I naturally gravitated to as a fourteen year old, a place where anonymity was a fundamental as breathing, where in order for genuine freedom of speech exist in an open society one had to be able to fully and anonymously express themselves. Satoshi Nakamoto is not a real name. Specifically, not a legal name. It is primarily the essence of thoughts and reason.”

However, crypto analysts and enthusiasts are not convinced that he is the real Nakamoto. It was well known in the crypto sphere that the founder of Bitcoin is an anonymous person or group of persons who wrote the whitepaper that gave birth to both the original crypto coin and blockchain technology. And according to them, this Nakamoto is just like the other wannabes—a fraud.

Bitcoin has posted a percentage increase of 4.15 percent during the course of the week. The largest crypto coin—with a market capitalization of over US$113.5 billion, started the week at US$6,380.38 after briefly diving below the US$6,000 level the week before. Bitcoin’s value currently stands at US$6,645.03 and is looking to break the US$6,800 resistance line.

| Related: Crypto Stores Now Offer Fast Bitcoin Cash Deals with Zero Confirmation