Cryptocurrency prices continue to slide down—albeit slowly—after Google banned virtual currency ads. Check the events affecting crypto price movements here.

This week is not a productive week for coin holders as cryptocurrency prices continue their slight downward trajectory. For the first part of the week—June 4 to 5—most of the top 10 cryptocurrencies based on market capitalization have experienced a gradual drop in prices. Know more in this Crypto Exchange June WK1 2018 Roundup.

This week is not a productive week for coin holders as cryptocurrency prices continue their slight downward trajectory. For the first part of the week—June 4 to 5—most of the top 10 cryptocurrencies based on market capitalization have experienced a gradual drop in prices. Know more in this Crypto Exchange June WK1 2018 Roundup.

Google Out, SEC In

The descent coincided with Google implementing its ban on crypto-related advertisements in June. The search engine has prohibited virtual currency ads aimed to protect its users from fraudulent crypto deals and initial coin offerings (ICOs). Meanwhile, the crypto industry cried foul. According to industry players, the blanket ban will also affect legitimate cryptocurrency businessmen

Ed Cooper, head of mobile at Revolut, said:

“Unfortunately, the fact that this ban is a blanket ban will mean that legitimate cryptocurrency businesses which provide valuable services to users will be unfairly caught in the crossfire. A more targeted approach would definitely be preferable: it would seem heavy-handed for example to put a blanket ban on all ads for job postings, anti-virus software or charities just because ads for these products and service are also sometimes used as an entry point by scammers to target consumers.”

Later that week, crypto prices recovered, and the graphs formed a slightly slanted plateau. Also that week, the head of US’ Securities and Exchange Commission (SEC)—Jay Clayton—shared his view that cryptocurrencies—compared to ICOs—are commodities and not securities.

Clayton, SEC chairman, said:

“Cryptocurrencies: These are replacements for sovereign currencies, replace the dollar, the euro, the yen with bitcoin. That type of currency is not a security.”

| Related: Crypto Exchange May WK5 2018

Bitcoin Cash, Cryptos Slighty Down

Bitcoin Cash (BCH) is coming to Japan. The Asian market is arguably one of the most powerful markets in the cryptocurrency world. Moreover, during this week, Bitcoin Cash evangelist Roger Ver has shared that the altcoin’s developers have discussed an agreement with a Japanese convenient store chain.

Bitcoin Cash (BCH) is coming to Japan. The Asian market is arguably one of the most powerful markets in the cryptocurrency world. Moreover, during this week, Bitcoin Cash evangelist Roger Ver has shared that the altcoin’s developers have discussed an agreement with a Japanese convenient store chain.

Ver said:

“Bitcoin Cash is coming to tens of thousands of convenient stores in Japan and you’ll be able to buy anything in the entire convenient store with Bitcoin Cash which means including like paying your electric bill.”

Bitcoin Cash followed the general trend, starting from US$1,201.06 before dropping to US$1070.44 on June 5. The following day, the altcoin was at US$1,149.15 and proceeded to a plateau. BCH currently stands at US$1,147.03, a 0.2 percent decrease from June 6’s price.

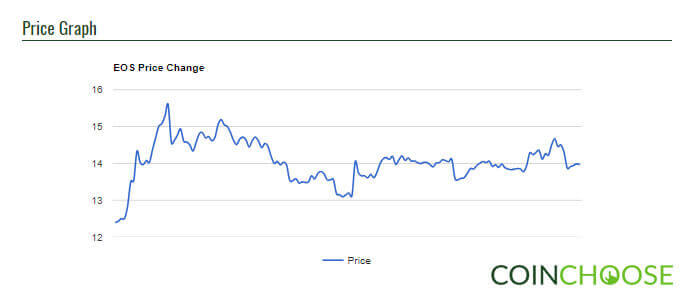

The EOS MainNet Launch Group (EMLG) announced the further delay of EOS’ MainNet and the freezing of EOS tokens on the Ethereum blockchain. The EMLG team has pushed the release date from early this June to an indefinite date. The developer and the community are currently testing two MainNet candidates. EMLG will present one of these candidates as EOS’ new blockchain, but only after a series of security and software testing.

The EOS MainNet Launch Group (EMLG) announced the further delay of EOS’ MainNet and the freezing of EOS tokens on the Ethereum blockchain. The EMLG team has pushed the release date from early this June to an indefinite date. The developer and the community are currently testing two MainNet candidates. EMLG will present one of these candidates as EOS’ new blockchain, but only after a series of security and software testing.

The ELMG, in a statement, said:

“Since the token freeze on 1 June… the [EMLG] has been working tirelessly toward a secure and seamless launch. Each day, the EMLG has met together via video conference from around the world to review strategic and tactical plans.”

However—even if the launch is delayed by more than a week—the graph showed that EOS did not lose that much from June 4 to June 8. This suggests that the market is still enthusiastic about how thorough the developers are before releasing the MainNet. EOS ended this week at US$14.668—a 0.3 percent decrease from June 4’s price of US$14.717.

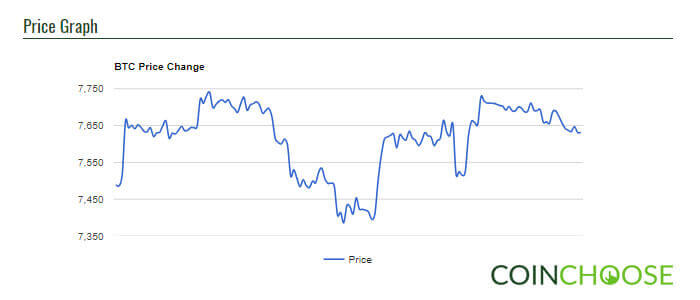

As Bitcoin (BTC) dropped more than 100 percent of its value from December 2017’s US$19,000, interest in the original coin has fallen as well. According to a Google Trends research, searches for Bitcoin have dropped by more than 75 percent since the beginning of 2018. In addition, the searches dropped by more or less 50 percent over the past three months. Also, according to a separate report from DataTrek research, growth in new Bitcoin wallets reached only around two percent in the months of April and May—far from December 2017’s 7.6 growth percentage.

As Bitcoin (BTC) dropped more than 100 percent of its value from December 2017’s US$19,000, interest in the original coin has fallen as well. According to a Google Trends research, searches for Bitcoin have dropped by more than 75 percent since the beginning of 2018. In addition, the searches dropped by more or less 50 percent over the past three months. Also, according to a separate report from DataTrek research, growth in new Bitcoin wallets reached only around two percent in the months of April and May—far from December 2017’s 7.6 growth percentage.

Nicholas Colas, co-founder of DataTrek Research, said:

“Bitcoin needs a new narrative in order to re-establish global attention. The [wallet] comparisons between the 2018 back half comps (excellent) and 2018-to-date (poor) are stark and explain essentially all of [Bitcoin’s] fall from grace this year. Simply put, history shows bitcoin wallet growth needs to be +5% [per] month to see meaningful price appreciation.”

While it followed the current sideways movement of most of the top 10 cryptos, Bitcoin showed a wilder fluctuation compared with other digital coins The Bitcoin starting price—US$7,714.79 on June 4—decreased only by 0.3 percent from Friday’s US$7,689.70.. The graph showed a gradual drop before recovering and another fall before bouncing back, indicating a constant challenge of the bulls to break the US$7,800 resistance level.

After a dismal May when digital coins valued at low prices, short-term investors are still looking for the best time to buy cryptocurrencies. While the current prices are significantly lower compared to the late 2017, analysts predict that crypto prices will eventually shoot back up in valuation before the end of this year.

| Related: Bitcoin Cash: Peer-to-Peer Electronic Cash for All