The crypto market's recovery was slightly halted by reports of exchange BIthumb being hacked. Know more about the factors affecting crypto prices here.

A hack into one of Korea’s biggest cryptocurrency exchanges midweek disturbed the recovering crypto market. However, coin prices managed to recover some of their losses thanks to developments from all across the crypto world. From June 18 to June 22, none of the top 10 cryptos based on market capitalization have posted a loss greater than two percent. Find out important factors that affected price movements in this Crypto Exchange June WK3 2018 Roundup.

A hack into one of Korea’s biggest cryptocurrency exchanges midweek disturbed the recovering crypto market. However, coin prices managed to recover some of their losses thanks to developments from all across the crypto world. From June 18 to June 22, none of the top 10 cryptos based on market capitalization have posted a loss greater than two percent. Find out important factors that affected price movements in this Crypto Exchange June WK3 2018 Roundup.

Bithumb Hack Not That Devastating

On June 20, news from the Korean peninsula shocked and worried crypto coin holders. Reports circulated that crypto exchange platform Bithumb lost more than KRW35 billion (US$30 million) worth of crypto coins. The biggest virtual currency exchange in South Korea—sixth in the world—later confirmed that its system was hacked. However, the exchange stated that there is a chance that the loss could be reduced further. In addition, Bithumb assured its clients that their losses would be compensated by the exchange.

Heo Back-Young, Bithumb CEO, wrote in a statement:

“Bithumb has been administering company’s asset and customers’ asset, and all customers cryptocurrencies as well as KRW asset are safely stored on cold wallet and bank respectively. Moreover, we would like to ensure that Bithumb currently has about [KRW500 billion] worth company’s fund. The amount of damage that occurred this time will be full covered by Bithumb’s own company fund, hence all our customers’ asset is intact and fully secured.”

The fear, uncertainty, and doubt to market participants following the hack managed to derail the price rebound that cryptos enjoyed in the first 48 hours of the week, from June 18 to 19. During that time, the crypto market added around US$12 billion to its total market capitalization. Graphs from the top 10 cryptocurrencies showed an upward trend during that same period, breaking from the bullish sentiment that dominated the market for the past two months.

Even with the bears controlling the market, big financial players see that there is potential in virtual currencies. One of them is Goldman Sachs CEO, Lloyd Blankfein. The head hinted at the possibility of the financial world adopting cryptos in the future, given that civilization has moved from gold to fiat money.

Blankfein, talking about Bitcoin (BTC), added:

“I’m not in this school of saying [Bitcoin is a fraud]… because it’s uncomfortable with me, because it’s unfamiliar, this can’t happen, that’s too arrogant.”

| Related: Crypto Exchange June WK1 2018

Recovering Prices for Bitcoin Cash, Other Cryptos

Bitcoin Cash (BCH) continues to tread the long-term bearish predictions of analysts, even with this week’s price recovery. The altcoin has lost almost 28.9 percent of its value in a span of 30 days. Its price challenged the US$900 resistance level to no avail, and it is currently poised to challenge two support levels at US$880 and US$825. If the price goes lower beyond the support levels, analysts warn Bitcoin Cash holders that the coin’s value could continue to descend. Otherwise, the altcoin’s price could climb and challenge the US$880 resistance level.

Bitcoin Cash (BCH) continues to tread the long-term bearish predictions of analysts, even with this week’s price recovery. The altcoin has lost almost 28.9 percent of its value in a span of 30 days. Its price challenged the US$900 resistance level to no avail, and it is currently poised to challenge two support levels at US$880 and US$825. If the price goes lower beyond the support levels, analysts warn Bitcoin Cash holders that the coin’s value could continue to descend. Otherwise, the altcoin’s price could climb and challenge the US$880 resistance level.

For this week, Bitcoin Cash’s value saw an increase of around 2.97 percent. The altcoin, fourth biggest in market capitalization, started the week at US$849.81 before ending the five-day timeframe at US$875.04.

Tron Foundation’s CEO and Founder Justin Sun has recently acquired peer-to-peer file sharing service BitTorrent for a reported cost of US$120 million. According to analysts, the decentralized nature of BitTorrent aligns perfectly with TRON’s (TRX) vision of a decentralized internet. No concrete plans on how TRON will benefit from BitTorrent have leaked yet, but Sun shared that there are planned activities between the two platforms in July.

Tron Foundation’s CEO and Founder Justin Sun has recently acquired peer-to-peer file sharing service BitTorrent for a reported cost of US$120 million. According to analysts, the decentralized nature of BitTorrent aligns perfectly with TRON’s (TRX) vision of a decentralized internet. No concrete plans on how TRON will benefit from BitTorrent have leaked yet, but Sun shared that there are planned activities between the two platforms in July.

Sun, in an interview on Huobi Talk, said:

“I have full respect for BitTorrent. It may be the first time that humans have used a large-scale decentralized peer-to-peer communication protocol. It was invented in 2001 and then was formally commercialized in large-scale in 2013. Its concept is very much in line with our blockchain world, and it is decentralized.”

The news brought the interest of the market back to TRON. The altcoin—the 10th largest in market cap—posted the highest increase in value among the top 10 cryptos in the market. In fact, its 14.52 percent price increase was significantly higher than any other coin in the group. TRON started the week at US$0.04257 before ending at US$0.04875.

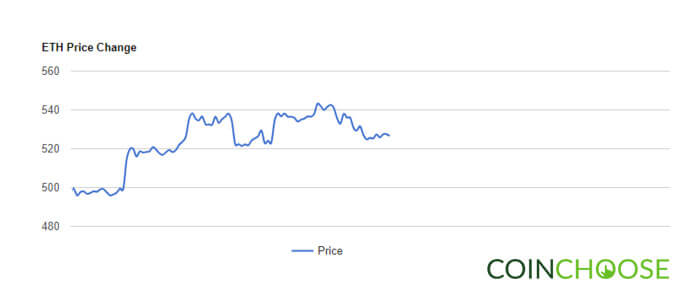

Ether (ETH) is not a security, according to a senior official at the US Securities and Exchange Commission (SEC). In a speech at Yahoo! All Markets Summit, SEC’s William Hinman shared that Ether, together with Bitcoin, are not considered securities.

Ether (ETH) is not a security, according to a senior official at the US Securities and Exchange Commission (SEC). In a speech at Yahoo! All Markets Summit, SEC’s William Hinman shared that Ether, together with Bitcoin, are not considered securities.

Hinman, director of SEC’s Division of Corporation Finance, said:

“Putting aside the fundraising that accompanied the creation of Ether, based on my understanding of the present state of Ether, the Ethereum network and its decentralized structure, current offers and sales Ether are not securities transaction.

This statement brought clarity to the status of Ethereum’s tokens. Cryptos not considered as securities escape the regulations imposed by SEC, and they fall under the rules imposed by commodities regulator Commodities and Futures Trading Commission (CFTC).

The altcoin—second largest in market cap—finished the week in the green with a 5.4 percent increase in value. That increase percentage was the second highest among the top 10 cryptos, only trailing TRON by some nine percent. Ether was valued last July 18 at US$499.38 and US$526.36 four days later.

State regulators now allow New Yorkers to trade Bitcoin on the Cash application. This is after payment company Square, run by Twitter CEO Jack Dorsey, received the virtual currency license allowing users in NY to trade cryptos legally using Cash. The app—used by more than seven million active users—is already being used for crypto trading in other states. Adding customers from the Big Apple, with a population of 8.5 million in 2016, can potentially bring a big boost to Cash’s downloads counter.

State regulators now allow New Yorkers to trade Bitcoin on the Cash application. This is after payment company Square, run by Twitter CEO Jack Dorsey, received the virtual currency license allowing users in NY to trade cryptos legally using Cash. The app—used by more than seven million active users—is already being used for crypto trading in other states. Adding customers from the Big Apple, with a population of 8.5 million in 2016, can potentially bring a big boost to Cash’s downloads counter.

Dan Dolev, Nomura Instinet analyst, told CNBC:

“That was one of the missing pieces in [Cash’s] puzzle. [It] had approval in most states, but New York was by far the biggest one where you couldn’t trade Bitcoin. This announcement gives people another excuse to download the app.”

Bitcoin—by far the biggest crypto in market cap—posted a small yet positive increase over the week. The original cryptocurrency saw a slight increase in value by 3.39 percent, the third highest increase among the top 10 for the week. Bitcoin started the week at US$6,510.07 before finishing at US$6,730.81.

| Related: Crypto Analysis—The Fundamental Process for All Traders