Cryptocurrency prices fell after governments of influential countries started investigations into possible crypto-related fraud and price manipulation.

A slight relief bounce failed to salvage cryptos’ performance this week as prices continued to descend. Regulations and investigations have scared investors into withdrawing their coins for the meantime, causing cryptocurrency prices to drop. At the same time, potential buyers are still on the lookout for the right time to purchase coins at their cheapest. Find out more in this Crypto Exchange May WK4 2018 roundup.

A slight relief bounce failed to salvage cryptos’ performance this week as prices continued to descend. Regulations and investigations have scared investors into withdrawing their coins for the meantime, causing cryptocurrency prices to drop. At the same time, potential buyers are still on the lookout for the right time to purchase coins at their cheapest. Find out more in this Crypto Exchange May WK4 2018 roundup.

Governments Examine the Market

Cryptocurrencies lost the trust of the investors, at least for now, as news of government-led investigations into possible crypto-related infringements occupied the front pages this week. Governments of two powerful nations have conducted their separate inquiries regarding possible fraud and market manipulation.

A coalition of North American regulators has formed Operation Cryptosweep which is tasked to look for and thwart cryptocurrency scams. According to an announcement, the task force had already set off more than 70 investigations into fraudulent ICOs and crypto scams. Some cases also lead to cease-and-desist letters for violating state laws.

The US Justice Department has started a probe into a possible manipulation of cryptocurrency prices. According to Bloomberg, federal prosecutors have teamed up with the Commodity Futures Trading Commission to review claims alleging trader collusion and illegal practices happening in the widely unregulated crypto market.

In South Korea, allegations of fraud and balance sheet inflation against UPbit caused the investigation and raid of the exchange platform’s headquarters. However, the government found no conclusive evidence to pin UPbit. While the exchange was found innocent of any wrongdoing, analysts suggested that the uproar caused by the probe will continue to affect the credibility of crypto exchanges in the Korean region.

Countries are still figuring out how to deal with this new technology. While some have decided to embrace digital currencies, others have called for cryptocurrency regulation.

The British Virgin Islands, allegedly under pressure from the US government, has intensified her fight against tax evasion and money laundering by cooperating with Bitfinex, the largest Bitcoin to US Dollar exchange platform. Bitfinex, whose headquarters resides in the BVI, has started requesting personal information from its clients which the exchange can share to local authorities. Investors unwilling to comply have pulled out their assets from Bitfinex.

| Related: Crypto Exchange May WK3 2018

Bitcoin Cash Dips Below $1,000

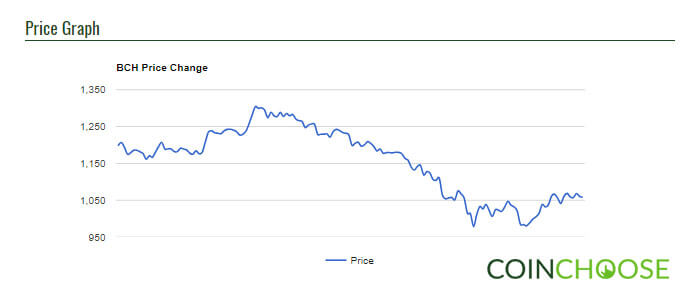

Bitcoin Cash (BCH), together with other digital coins, continued to experience drops in prices. The altcoin’s hard fork failed to save Bitcoin Cash from following the general price trend, with investors still unimpressed by the new upgrades. Bitcoin Cash is once again one of the worst performers this week, losing 14 percent of its value from May 21 to 25. At one point, Bitcoin Cash dropped to as low as US$963.15 late in the week before recovering a little to hover just above the US$1,000 level. Bitcoin Cash is currently priced at US$1,046.79.

Bitcoin Cash (BCH), together with other digital coins, continued to experience drops in prices. The altcoin’s hard fork failed to save Bitcoin Cash from following the general price trend, with investors still unimpressed by the new upgrades. Bitcoin Cash is once again one of the worst performers this week, losing 14 percent of its value from May 21 to 25. At one point, Bitcoin Cash dropped to as low as US$963.15 late in the week before recovering a little to hover just above the US$1,000 level. Bitcoin Cash is currently priced at US$1,046.79.

Two cryptocurrencies will be having their new home soon. EOS (EOS) and TRON (TRX), both currently operating in the Ethereum (ETH) network, will migrate to their own respective blockchains. EOS is scheduled to launch its MainNet EOS.IO on June 1, while TRON will launch its own MainNet Odyssey at the end of this month.

EOS, among the top 10 cryptocurrencies, is the week’s best performer. From May 21 to25, the digital coin lost only 7.55 percent in value. While May 21 to 23 looked grim after losing more than 19 percent, EOS bounced back and recovered most of its losses. EOS is currently priced at US$12.49.

Meanwhile, TRON failed to capitalize on its productive weekend and dropped more than 12 percent during May 21 to 25. TRON’s nearing MainNet launch increased its price by around 24 percent earlier this week, before following the general trend and dropped to as low as US$0.067912. TRON is currently priced at US$0.072751.

With uncertainty toward the success of these two MainNets, expect their prices to fluctuate even more.

Bitcoin Core, still the largest crypto on the market, looked like a shadow of its former self after losing 9.69 percent this week. Bitcoin Core, who was just challenging the US$10,000 mark earlier this month, started the week at US$8,418.99 before continuing its freefall to as low as US$7,335.86. The coin recovered a little and is now priced at US$7,603.25

| Related: Bitcoin Cash: Peer-to-Peer Electronic Cash for All