Bibox is a crypto exchange platform launched in 2017 that utilizes artificial intelligence to offer simpler and more secure trading services.

Bibox is a decentralized digital asset exchange platform launched in November 2017. The exchange uses artificial intelligence (AI) technology to assist investors in trading Bitcoin (BTC), BIX token (BIX), and other cryptocurrencies.

The project’s founding team is full of leading blockchain technology and crypto experts in China. The current CEO is Jeffery Lei, co-founder of Chinese trading platform OKCoin.

Less than a year after its release, Bibox has entered CoinMarketCap’s list of top 20 exchanges ranked by monthly transaction volume. As of September 25, the exchange—with more than 100 trading pairs—has processed a reported US$6.1 million worth of transactions for the past 30 days.

Exchanges Lenient, Lacking

In its whitepaper, the Bibox team enumerated what it described as “the pain points of cryptocurrency exchanges.”

According to Bibox, most exchanges do not perform stringent analysis when listing tokens issued by initial coin offerings (ICOs). Worse, the platform’s team claimed that other trading sites lack the dedicated process for examining prospective tokens.

Bibox asserted that the leniency of these exchanges could allow shady coins to enter the market, which could hurt the entire scene. The document cited Gresham’s law, an economic principle stating, “bad money drives out good.”

This AI-based exchange also pointed out that most exchanges do not offer a huge variety of trading strategies. The team said that not only do these exchanges lack the system to short cryptos, but they also do not have leverage and security lending services.

Furthermore, Bibox claimed that customers have bad experiences trading with most exchanges as these platforms have poor user interfaces and inadequate asset protection.

Services Powered by Artificial Intelligence

To avoid these problems, Bibox offers to both beginner and advanced-level investors a number of important trading options coupled with an AI trading assistant. These include:

- Planned Order – This option executes an order when the asset reaches a preset price.

- Conditional Order – This type of order triggers when certain conditions specified by the user are met.

- Iceberg Order – This type divides a large order into smaller ones. A small part is placed on the market, while the other parts remain hidden until the public order is fulfilled.

- Time-Weighted Average Price – This option also splits a large order over time. The order will be in effect once the asset reaches its average price over a defined period.

- Stop Loss/Gain Order – These order type sells the asset once a certain price level has been reached.

Apart from spot trading, Bibox also offers margin trading, security lending, and contracts trading.

Crypto holders can deposit their funds on Bibox for free. Meanwhile, transactions will cost clients a 0.1 percent trading fee. However, customers paying in BIX will receive a 50 percent discount on the trading fee.

Crypto holders can deposit their funds on Bibox for free. Meanwhile, transactions will cost clients a 0.1 percent trading fee. However, customers paying in BIX will receive a 50 percent discount on the trading fee.

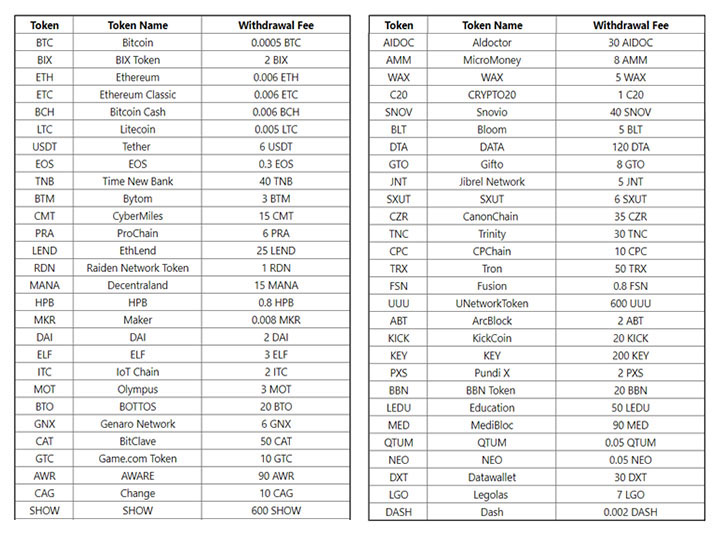

The amount of withdrawal fees depends on the crypto pulled out from Bibox. The exchange charges 0.0005 BTC for Bitcoin withdrawals, 0.05 NEO for NEO, and 0.05 DASH for Dash, to mention a few.

Investors can also stay relaxed as each of the cryptos listed on Bibox underwent testing from a team of blockchain experts. The examination includes factors such as team strength, community support, technical strength, and project development.

Bibox to Reach the Top?

One of Bibox’s main goals is to apply AI in the growing world of crypto trading. The company has recognized the benefits AI technology could deliver, from automating trading options to detecting fraudulent behavior.

Looking at the long term, Bibox aspires to become the most liquid exchange platform in the scene. With AI and smooth user interface experience, it is most likely that Bibox is on the right path.