Research by Blockchain Transparency Institute claimed that OKEx, Huobi, and HitBTC are inflating their Bitcoin trading volumes by wash trading.

Three top cryptocurrency exchange platforms have been inflating their reported trading volumes, a blockchain research firm claimed.

For their December online report, researchers from the Blockchain Transparency Institute recently found sufficient evidence suggesting that Hong Kong-based OKEx, Singapore-based Huobi, and European exchange HitBTC are wash trading.

In this practice, a trader purchases and sells a digital asset to artificially boost trading volumes and to mislead unsuspecting market participants. This could be done by specifically programmed trading bots, which the researchers found prevalent in crypto exchanges.

In this practice, a trader purchases and sells a digital asset to artificially boost trading volumes and to mislead unsuspecting market participants. This could be done by specifically programmed trading bots, which the researchers found prevalent in crypto exchanges.

Wash trading on traditional stock markets is outlawed in the United States, among others.

The Blockchain Transparency Institute explained:

“[We] just found just about all of [OKEx’s] top 30 traded tokens to be engaging in wash trading when processed through our algorithms. Huobi also appears to be inflating their top 30 pairs volume numbers, but to a lesser degree than OKEx. HitBTC’s top 25 has shown clear evidence of wash trading as well.”

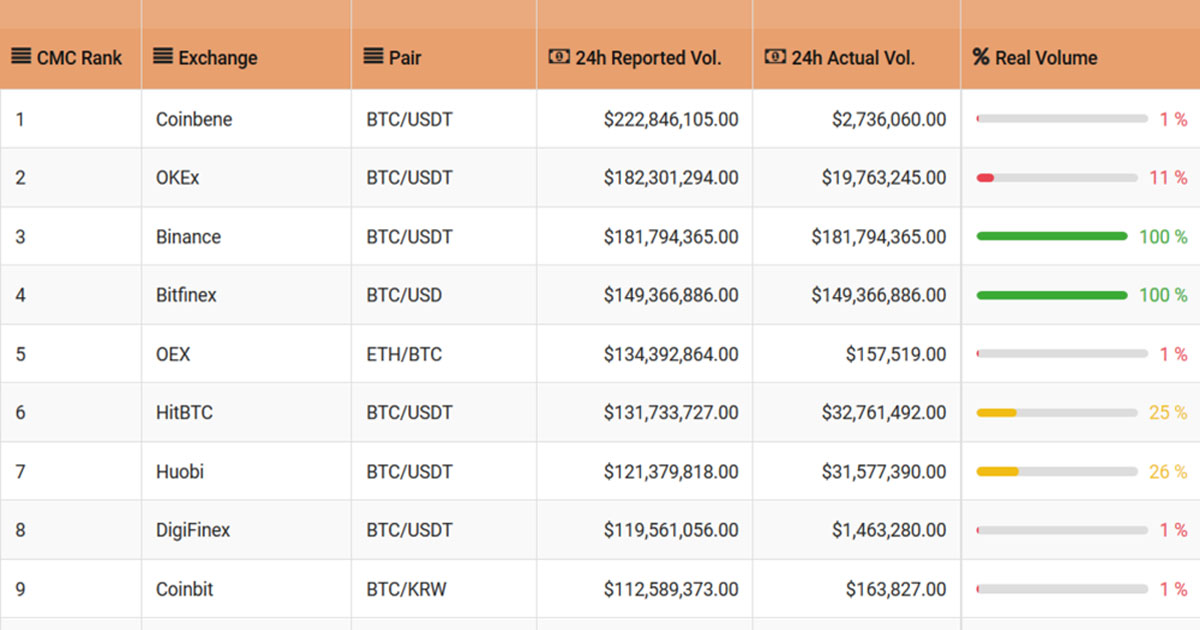

According to the table presented, only 11 percent of the BTC/USDT volume on OKEx is genuine, while Huobi and HitBTC posted only 26 and 25 percent, respectively.

Meanwhile, the same research data also showed that Bitcoin trading volumes on both Bitfinex and Binance are 100 percent genuine, or at least showed no discernable signs of wash trading.

| Related: ID Please! CEX.IO Crypto Exchange Users Now Need to Verify Their Identities