The cryptoverse is abuzz as Worldcoin pivots from USDC to its native WLD for Orb Operator rewards. Dive into the latest crypto shakeup!

If there’s one thing that never sleeps in the cryptoverse, it’s change! Just in, Worldcoin, the crypto that’s been buzzing louder than a faulty GPU fan, has thrown a curveball at its ecosystem contributors. Say goodbye to those USDC rewards for Orb device operators. Why? It’s WLD season now!

Switching Lanes – From USDC to WLD:

The Worldcoin Foundation has flipped the switch and made a mega change in the reward system. During what they cheekily termed a “transitional phase” post-launch, Worldcoin Operators, the folks operating those sci-fi-esque Orbs, were riding the stablecoin wave and getting paid in USDC. But as of October 10, in a bold pilot program, these rewards have started pouring in Worldcoin’s native token – WLD.

A little backdrop for the uninitiated: these Orbs are no mere decoration. Worldcoin Operators utilize these custom imaging devices to verify the uniqueness and, well, “humanness” of individuals. Think of it as a futuristic crypto handshake, ensuring you’re a living, breathing human and not some bot lurking in the shadows.

WLD Token’s Journey So Far:

Launched on July 24, the WLD token isn’t your average newcomer. With its roots firmly outside the US and certain restricted territories, WLD has seen quite the rollercoaster since its inception. Hitting an all-time high of $3.30 on the launch day and then experiencing a dip to $0.97 in September, this token’s been giving hodlers a nail-biting experience. However, hodlers might be cracking a smile, given the token’s impressive 59% rise from its all-time low. Not to mention, a whopping 800,000 Orb-verified users have already claimed around 34 million WLD in free user grants. That’s a lot of crypto confetti flying around!

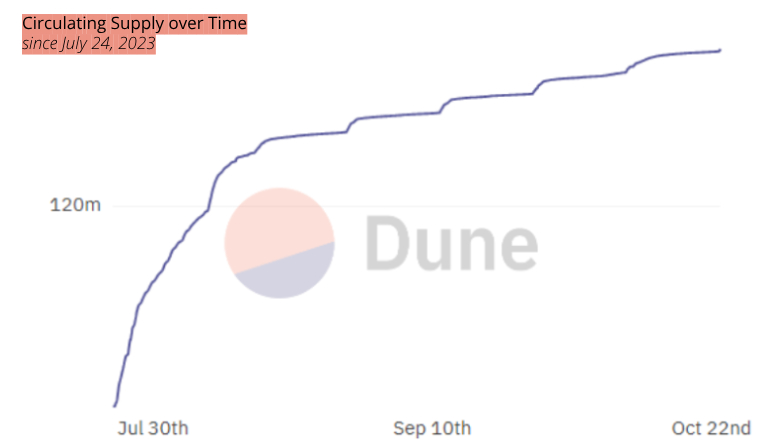

What Does the Circulating Supply Look Like?

Dive a little deeper, and you’ll find the circulating supply revealing some interesting stats. We’re looking at a jump from 100 million to a staggering 134 million WLD. Break it down, and you’ve got 100M WLD in loans stretched out to market makers, roughly 34.3M WLD from those user grants we mentioned earlier, and a sprinkle of WLD dished out as Operator rewards.

The circulating supply of WLD tokens, as per data from Dune Analytics.

Spicing Up the Liquidity Game:

World Assets Ltd., Worldcoin Foundation’s subsidiary, made some suave moves at launch. They secured loan agreements with five market makers, all to ensure the WLD tokens had enough liquidity outside Uncle Sam’s land. But, in a recent twist, while the loan agreements have been extended to December 15, the loan amount’s taken a haircut from 100M to 75M WLD. The circulating supply is about to get a shakeup, with a potential reduction of up to 25M WLD on the horizon.

Bottom Line:

In the fast-paced dance of crypto, Worldcoin’s recent moves highlight its ambition to cement its place in the ever-expanding cryptoverse. As for the Worldcoin Operators? Well, they better start loving WLD, because that’s what’s going to be jingling in their digital wallets from now on!